Antler's Framework for Finding the Right Problem to Solve | VC Jobs

"Great Companies Focus On Solving Heart-Felt Problems" & Spotify’s DIBB Framework.

👋 Hey Sahil here! Welcome to this bi-weekly venture curator newsletter. Each week, I tackle questions about building products, startups, growth, and venture capital! In today’s newsletter, we dive into -

Deep Dive: Antler's Framework for Finding the Right Problem to Solve - “Great Companies Focus On Solving Heart-Felt Problems.”

Quick Dive:

Spotify’s DIBB Framework Features for Better Decision-Making

Paypal's ‘Going Sharp’ Strategy To Find Product Market Fit.

Fundraising is a Tactic, Not a goal.

Track LTV & CACD, Not LTV/CAC Ratio - Here's Why?

Major News: a16z Backed Fintech Startup Filed For Bankruptcy, Massive 61K Bitcoin Seizure in UK Investigation, Peter Thiel's Founded VC Firm Raised $300 Million, Musk Raised $6 Billion For AI Startup From a16z & More

Best Tweet Of This Week On Startups, VC & AI.

VC Jobs & Internships: From Scout to Partner.

IN PARTNERSHIP WITH CONTRARIAN DESIGN

Contrarian Design - Product Design For Busy Dev Teams.

Developers can only take your product so far → Go to the next level by handing your developers top-notch designs instead

Searching, vetting & training designers takes time → Get design deliverables next week instead - We are experts at designing complex interfaces → 15 years of experience at top tech companies.

PARTNERSHIP WITH US

Want to get your brand in front of thousands of founders, investors, executives, and startup operators? For details on our sponsorships, fill up this quick form and we’ll get in touch.

TODAY’S DEEP DIVE

Antler’s Framework To Find The Right Problem To Solve.

The Classical school of Economics chanted, "Supply, creates its demand!” Fast forward to the modern era, the “supply first'' days are long gone. We live in an age of abundance, and new-age entrepreneurs must find the customer demand before creating supply. In modern entrepreneurship, this saying has reversed: "Demand creates its supply."

Where do you think demand originates from?

The answer is simple: From a problem waiting to be solved!

If you closely look at any long-lasting business, you'll realise that its core idea germinated from solving customers’ heartfelt problems. A significant and market-relevant problem. No surprise that Uri Levine, the founder of Waze, suggests, "Fall in love with the problem, not the solution." In this writeup we will dive into -

Great companies focus on solving heartfelt problems.

What defines a heart-felt problem?

The five characteristics of heartfelt problems

How do you identify if a heart-felt problem is worth solving?

Great companies focus on solving heart-felt problems

A study conducted by the Harvard Business Review confirmed that 85% of executives believe that their organisations diagnose problems poorly. Most of them agree that this results in poor time and cost management and lost opportunity costs.

Problem-solving involves finding innovative and creative solutions to address societal, technological, or business-related problems.

Take, for example, WhatsApp's story. When its founders started the company, their main focus was on solving heart-felt problems concerning the high cost of international communication. This societal problem has existed for centuries since empires started to take over the world.

WhatsApp wasn’t the only player in this space—Viber, Google Allo, Kik, Skype, and even FB Messenger were competing in the market.

The team at WhatsApp recognised that mobile carriers and other apps were going against the customer problem. Competitors like Viber and Skype limited the experience by charging for international VOIP calls, and mobile carriers were charging exorbitant prices for international SMS.

WhatsApp doubled down on the customer problem and created features like free calls, free instant messaging, and only 99 cents for the app.

The bet paid off, and they grew by 100M users every month. The exit? A whopping $19 billion from Meta with only a team of 32 people.

What does this tell us?

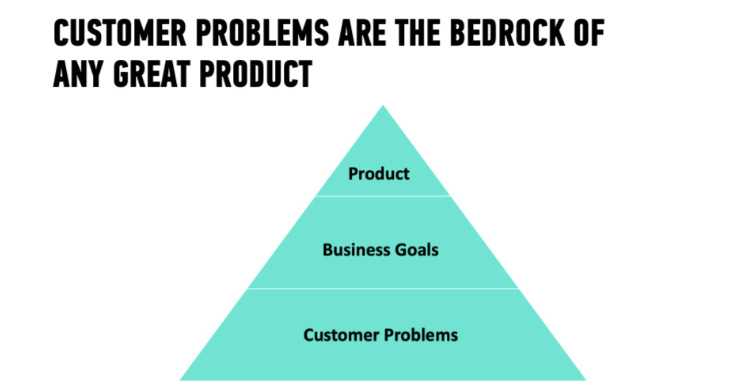

Customer problems are the North Star for all great companies.

WhatsApp was able to focus relentlessly on the need for cheaper and faster international communication. Every decision they made focused on making communication more affordable and quicker for their users.

Source: Product Academy / Antler

Customer problems don’t change; it’s only technology and customer behaviour that does.

WhatsApp wasn’t the first app to democratise communication, and Amazon wasn’t the first e-commerce company. If it’s a valuable problem, someone is already solving it. So don’t jump into solutions too quickly for fear of losing market share.

“Competing on a solution is a zero-sum game that eventually leads to a feature war, then a price war and all value is eventually destroyed.

In the startup world, the onus lies on founders to fall in love with the customer problem. When the customer problem is clear, founders can create solutions from new customer behaviours and emerg

ing technology trends to create innovative businesses.

So how do you identify a heart-felt problem for your customers? Let’s take a look.

What defines a heart-felt problem?

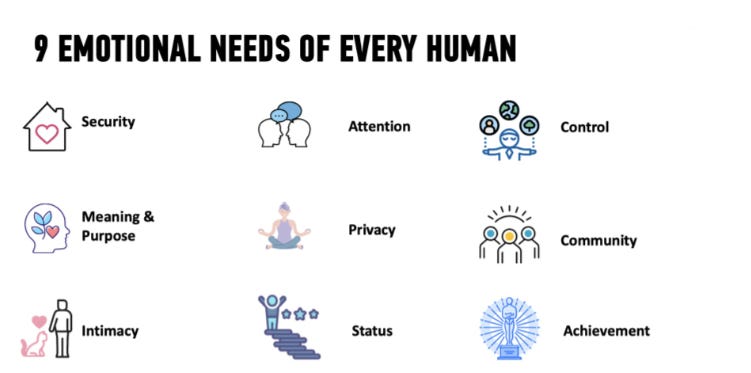

Customer problems exist across multiple layers. There’s a surface layer where they tell you a solution they have in mind—like I want to save money making international calls. But at its core, all problems distil down to one or a few of these emotions:

Security

Attention

Control

Meaning & purpose

Privacy

Community

Intimacy

Status

Achievement

Source: Product Academy / Antler

How many of these emotional problems do you think WhatsApp solves?

Great entrepreneurs look beyond the customer-suggested problems. They ask “5 whys” until they get to the emotional reason that causes a customer to seek out a product.

Take the case of Slack, a workplace communication tool that has revolutionised how offices communicate.

Before Slack existed, office communication relied on email. The email was designed to be formal and disposable. However, Slack channels allowed teams with a shared interest to create more inclusive communication for everyone.

Suddenly, people working on the same project can create a project channel with a “searchable log of all communication and knowledge” (which is what SLACK stands for). What used to be an email thread now has a permanent space to foster a discussion around a common goal.

People can create project channels, shared interest channels, to company announcements. Giving internal teams shared meaning and purpose for the company they work in.

Companies are not buying Slack to replace emails but are buying Slack for the sense of community, meaning and shared purpose.

The five characteristics of heartfelt problems

Here are the five characteristics of heart-felt problems. The deeper the pain, the more value you can get from your customers:

Emotional — the problem must have an emotion attached to it

Functional — the problem must fulfil the basic functional need of the problem

Frequent — the problem must happen frequently enough for the user to justify the value

Urgent — the problem must have an impending deadline

Unavoidable — the problem must not have an easier way to get around the problem

Source: Product Academy / Antler

It’s the entrepreneur's job to identify these five characteristics of a heart-felt problem and provide a solution to solve it well.

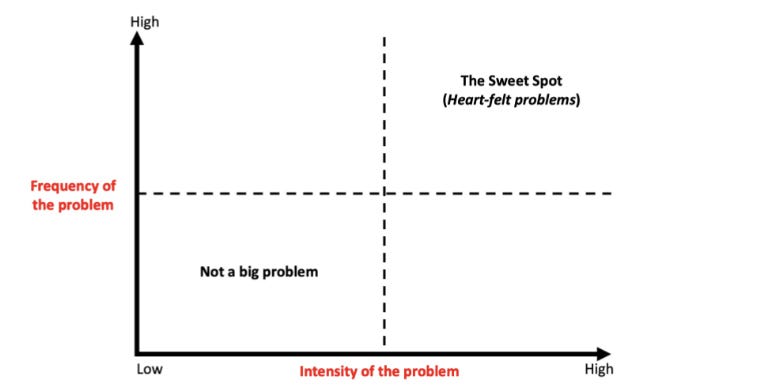

So, how do you identify if a heart-felt problem is worth solving?

"In a great market—a market with lots of real potential customers, the market pulls product out of the startup. Conversely, in a terrible market, you can have the best product in the world, and it doesn’t matter—you’re going to fail."

- Marc Andreessen

You’ll need to generate product ideas from market research and then identify customers' problems in that market to solve.

The first step is to research the market you want to be a part of. The opportunity size is based on how much your customer is spending to solve the problem right now. This information can come from industry research, government websites, and annual reports of key competitors, or you may even need to commission research if it’s too niche.

Useful tools to gather information about your market: Statistica, AnswerThePublic & Gartner etc.

Once you’ve gathered the market size of your product, you can start to identify the heart-felt problems for your customers.

You need to get out of your comfort zone and speak with your target customers. Put yourself in their shoes, and think about the problem you’re trying to solve.

Ask yourself:

If this customer problem exists, where would your customers go to solve it?

Chances are there are existing communities or media channels that connect your potential customers. Go there.

Don’t be afraid to speak with your competitor’s customers to understand why they purchased the product and what problem it was solving for them. It’s a free market.

Source: Product Academy / Antler

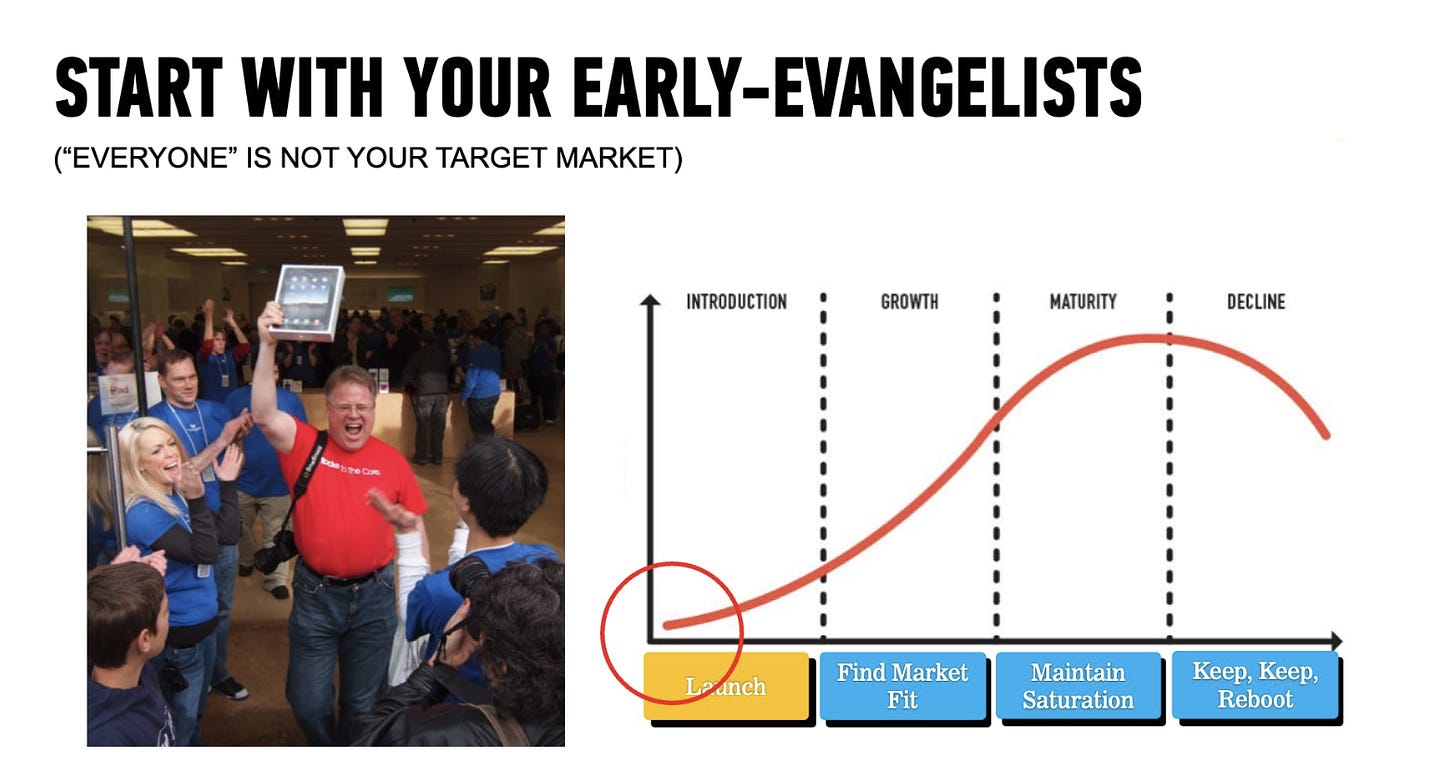

The goal is to find your small set of early adopter customers—people who will tell their friends about your product. Look for the most profitable customer segment to start there.

Don’t fall into the trap of trying to target “everyone” (it’s a trap). You’ll spread yourself too thin and lose sight of the core customer problem.

Source: Product Academy / Antler

There is no magic number of how many customer interviews you speak with. I like to start with five customers first, then adjust my questions every five customers until I’ve honed in on a deep enough problem with a large enough market size.

For B2B products, you’ll need to be more creative and treat customer interviews as a networking opportunity. You need to rely on introductions, conferences, meetups, host events, or even work in the industry to build a network. You need to pay it forward long before you can draw on the favours for customer insights.

Using the Jobs-To-Be-Done interview popularised by Clayton Christensen is an excellent method to speak with customers.

The trick is to find a deep customer problem in a market that is large enough to sustain your vision. 99% of the world’s problems are not worth solving but if you persist, you’ll eventually find one.

That’s it.

If you're a founder seeking guidance, look no further than the must-follow resources meticulously developed by Antler's Academy. (Featured Article)

QUICK DIVES

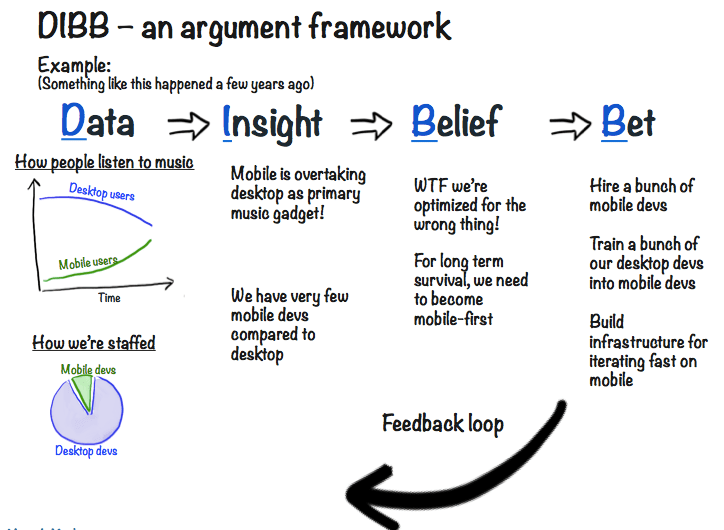

1. Spotify’s DIBB Framework Features for Better Decision-Making

Spotify created the DIBB Framework to help align its entire organization around a consistent decision-making process. It helps founders derive insights from their data and identify the right calculated risks to take.

There are four parts to it:

Data → Gather and analyze accurate data that are relevant to the problem you’re solving

Insight → Look for patterns, trends, and insights in the data to inform decision-making

Belief → Create a hypothesis based on your insights and gain conviction

Bet → Test your beliefs with action and define expected outcomes

What I like about this is that it feels very similar to what founders naturally do: collect data points/trends, identify an opportunity, gain a conviction, and then take a shot at it.

Not all of your bets will work out, but that’s ok — you shouldn’t expect them all to. The important thing is that each bet is focused on driving your startup’s North Star goals.

2. Paypal's "Going Sharp" Strategy To Find Product Market Fit.

In November 1999, PayPal founded the Product Market Fit (PMF) - When it identified a clear and urgent pain point for a large and growing market: online payments, particularly focusing on eBay users who needed a convenient way to pay and get paid for their online auctions.

The company's growth skyrocketed after it dropped other plans and went all-in on the eBay use case, with the number of users increasing from less than 10,000 at the end of 1999 to 5 million by the summer of 2000.

This is a result of PayPal's sharp startup strategy, which still works today. So, let's deep dive into this strategy and understand how PayPal used this strategy to Find PMF.

Whereas the average startup launches a bunch of features for a bunch of use cases to appeal to many possible users, the Sharp Startup focuses on a few killer features for the most desperate customer segment. In short, it finds a wedge in the market.

The Sharp Startup focuses on the most desperate customer segment. It finds a wedge into the market.

While it’s important to have a larger vision, the Sharp Startup remains opportunistic and agile enough that when it spots this kind of opening in the market, it drops everything else and drives all of its troops through it.

David Sacks, who was leading product at Paypal, shared the story of how Paypal found product-market fit -

“It was November of 1999 when one of their customer service rep forwarded him an email from an eBay power seller. The eBay seller had turned the PayPal logo into a nice-looking button for her auctions and was asking PayPal’s permission to use it.

The irony of this situation was, that this email was forwarded not because of product reasons but because of legal reasons as David Sacks was handling companies’ legal affairs owning to his degree in law from Stanford. It was a potential trademark infringement question. Anyhow, he brought up this email to Luke Nosek (co-founder of PayPal, then CMO of PayPal). They said and I quote (from notes shared by Dave in his blog)

It seemed extraordinary that an eBay seller had taken the time to create her own PayPal auction button. If she cared that much, how many others did too?

PayPal did what great companies do. They captured the opportunity and tested the found product market fit…

They went to the eBay website and searched for ‘PayPal’. Hundreds of auctions appeared in the search results because PayPal was mentioned in the item description as a possible method of payment. This was the AHA! moment and PayPal found its product-market fit. Even more interesting to learn is their plan to implement and capture this moment.

In the meantime, Luke had come up with the signup-referral program. Now see how PayPal productized this idea. They told auctioneers, they were free to use the PayPal logo, in-fact PayPal created a nice logo for them and even inserted it in their auctions, and on top of that gave $10 for every referral (more on referral in the next chapter).

This spread like wildfire in a tight-knit eBay community. Soon, most of the auctions were advertising PayPal. They dropped all other plans and went full steam with this idea. Soon they reached 10,000 users by the end of 1999. By early 2000, they had 100,000 users.

A few months after that they reached a million and by the summer of 2000, they had 5M users. The growth curve looked like a perfect hockey stick.”

It was a classic Sharp strategy: Paypal identified the most desperate customer segment, went all-in on their use case, and found ways to turbo-charge the adoption.

Notably, many of the key features were distribution tricks, not just product enhancements. As a result, PayPal captured the key beachhead market of the nascent online payments space, ahead of its many competitors.

You might be thinking - Paypal got lucky in this! Agree they got lucky for not sending the customer service email to the spam folder.

But you can use this strategy to find PMF for your startup, how? By -

Focusing on solving a specific problem for a specific market.

Leveraging their competitive advantage and network effect.

Being flexible and adaptable to changing market conditions.

3. Track LTV & CACD, Not LTV/CAC Ratio - Here's Why?

For a business to be viable and sustainable, the cost of acquiring a new customer (Customer Acquisition Cost/CAC) should be lower than the total value that the customer generates over their lifetime (Lifetime Value / LTV).

Startups often fail because their CAC exceeds LTV. Investors obsess over the LTV/CAC ratio as it represents potential ROI.

However, looking at the overall LTV/CAC provides limited insights. Businesses should analyze LTV/CAC by customer cohort since not all customers are equal in lifetime value. Tracking cohort-level LTV/CAC allows for optimizing acquisition efforts towards high-value customers.

However, focusing solely on the LTV/CAC ratio is not enough.

4. Fundraising is a Tactic, Not a Goal.

It’s time for founders to reevaluate the pursuit of funding.

Don’t get me wrong, raising capital is a milestone for a startup and can dramatically change the trajectory of your business. It’s also challenging to pull off — everything from your approach to how you sell it, to just some luck around the timing of the deal relative to what else investors have seen all has to go in your favour.

But don’t treat it like your goal — a founder that optimizes for fundraising above all else is likely not spending enough time on their customers or product. As Paul Graham says, the defining characteristic of the best founders is that they are relentlessly resourceful.

Scott Belsky puts it slightly differently:

“ Financing is a tactic, not a goal.

As I think about the implications of the new world of capital, I am most excited about the potential of very sober start-ups that value resourcefulness more than resources - and are not numb to the true motions of their business or any indifference to their products. We will see more startups bootstrap themselves longer, monetize sooner, and pressure test their business plan in ways that prioritize product-led growth and leverage extreme empathy to nail product-market fit (rather than compensate with paid customer acquisition).

Financing will become more tactical, and less of an ego-driven media-honeypot focal point. Somehow, over the last two decades, raising money for a new company became a badge of honour and a pursuit in and of itself. Ironically, the ultimate form of validation in entrepreneurship requires money to build a sustainable business. Nevertheless, the proxy for being a high-potential company became a VC buying part of your company after a relatively quick round of diligence in the short time frame of a competitive market. Ultimately, the employees of companies that over-raised capital just because they could likely suffer the consequences as reality (and down rounds) roll in. Strong businesses, perhaps even businesses that optimize for resiliency and strong unit economics more than astronomical growth rates, will come back in vogue. And this will be great for employees and investors alike, so long as they are willing to work hard enough and commit long enough to figure it out.” (From X)

Look at companies like Zapier that reached a $5B valuation while only raising $1.3M. Be proud of how much you can get done with limited resources.

Join 25000+ Founders, Investors and Startup Enthusiasts Getting Tactics To Build, Learn and Implement About Startups and Venture Capital.

THIS WEEK’S NEWS RECAP

Major News In VC, Startup Funding & Tech

British authorities seized over 61,000 bitcoins worth around £3 billion from a woman named - wen jian, marking one of the largest cryptocurrency seizures by law enforcement globally. Read Here

Synapse, an a16z-backed banking technology startup that raised over $50 million has gone bankrupt, affecting 10 million end customers. Read Here

Elon Musk's AI startup, xAI, raised $6 billion in a funding round at a $18 Billion valuation. Read Here

Nvidia's most advanced AI chip for China, the H20, has seen weak demand and abundant supply, forcing it to be priced lower than Huawei's rival Ascend 910B chip. Read Here

Valar Ventures, a VC firm co-founded by Peter Thiel, has raised a $300 million fund, much smaller than its previous funds of over $600 million. Read Here

→ Get the most important startup funding, venture capital & tech news. Join 20,000+ early adopters staying ahead of the curve, for free. Subscribed to Venture Daily Digest Newsletter.

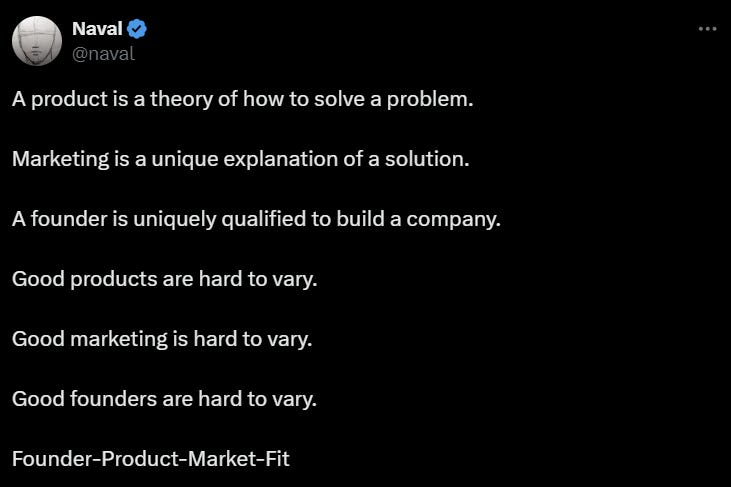

TWEET OF THIS WEEK

Best Tweet I Saw This Week

How Can I Help You?

Build Your Pitch Deck: We write, design and model your pitch deck into a storyteller book within 4-5 days.

Get Your MVP In 15 Days: Have an Idea? Turn your idea into Reality. Move fast before your competitors.

TODAY’S JOB OPPORTUNITIES

Venture Capital Jobs & Internships

Investment Associate - Digital Currency Group | USA - Apply Here

Head of Finance - W23 Global | Australia - Apply Here

VC Senior Vice President - Citi Venture | UK - Apply Here

Senior Associate - Adutum Bio | USA - Apply Here

Associate -Aditu | Bio USA - Apply Here

Investor - Galaxy Venture | USA - Apply Here

Operations and Events Associate, Future of Finance Accelerator - Techstars - Apply Here

Associate BYND Venture Capital | Spain - Apply Here

Investment Analyst Intern - Titan Capital | India - Apply Here

Analyst - BDC Capital | Canada - Apply Here

Sr. Investment Manager / Sr. Associate - Lam Capital | USA - Apply Here

Director - NYS Innovation VC Fund | USA - Apply Here

Venture Partner - Erez Capital - Apply Here

General Manager - Techstar | UK - Apply Here

🧐 Some Tips To Break Into VC:

An Insider's Guide On How to Land Your First VC Role.

Landing a role in the venture capital industry is fiercely competitive due to the catch-22 of needing the experience to gain experience, which is especially pronounced in VC where most candidates lack the capital, access, or relationships to break in.

However, this post provides insights from investors who successfully found their way into VC and highlights what established investors look for when searching for new talent.

The truth is, despite how daunting it might appear, there are multiple paths into the VC world, though it remains challenging.

For those short on time, the main takeaway is that breaking into VC requires persistence and creativity in gaining relevant experience and building the necessary connections within the industry.

Go niche and specialize in one or two core VC functions combined with deep expertise in a specific space/business model to stand out.

Differentiation is crucial as founders choose whom to bring to their cap table in an increasingly competitive market.

Have a clear "why" and passion for the craft of venture investing that will sustain you.

Start doing VC work informally before getting a formal role, like angel investing or advising startups, to build experience and credibility.

Building relationships and networking with investors, founders, and experts is vital in the relationship-driven VC world.

Download the free e-book.

→ Looking To Break Into Venture Capital?: Join our VC Crafter community and get access to VC learning resources, daily VC job updates, daily discussion sessions, 1:1 call access, worked as a scout for various VC firms, a CV/Interview preparation guide and more. Don’t miss this opportunity….

→ Looking to hire for your VC Firm?: We have a curated list of VC enthusiasts - from leading universities, ex-founders, and operators. Get free access here.