What Do Investors Need From The Problem Slide? & Do Startup Need Financial Model? | VC Jobs

Selling your business model to VC & Udemy fundraising journey..

👋 Hey Sahil here! Welcome to this bi-weekly venture curator newsletter. Each week, I tackle questions about building products, startups, growth, and venture capital! In today’s newsletter, we dive into -

Deep Dive: What Do Investors Need From The Problem Slide?

Quick Dive:

Udemy Founder - “The investors had the right question, but the wrong conclusion.”

How to Sell Your Business Model to VCs?

Why Your Startup Idea Isn’t Big Enough for Some VCs? - RTF Analysis.

Do Startups Need a Financial Model?

Major News: Databricks Co-founder Launched VC Fund, SoftBank Leads $1 Billion Funding For Self Driving Startup & Microsoft Building Its LLM Model, MAI-1.

Best Tweet Of This Week On Startups, VC & AI.

VC Jobs & Internships: From Scout to Partner.

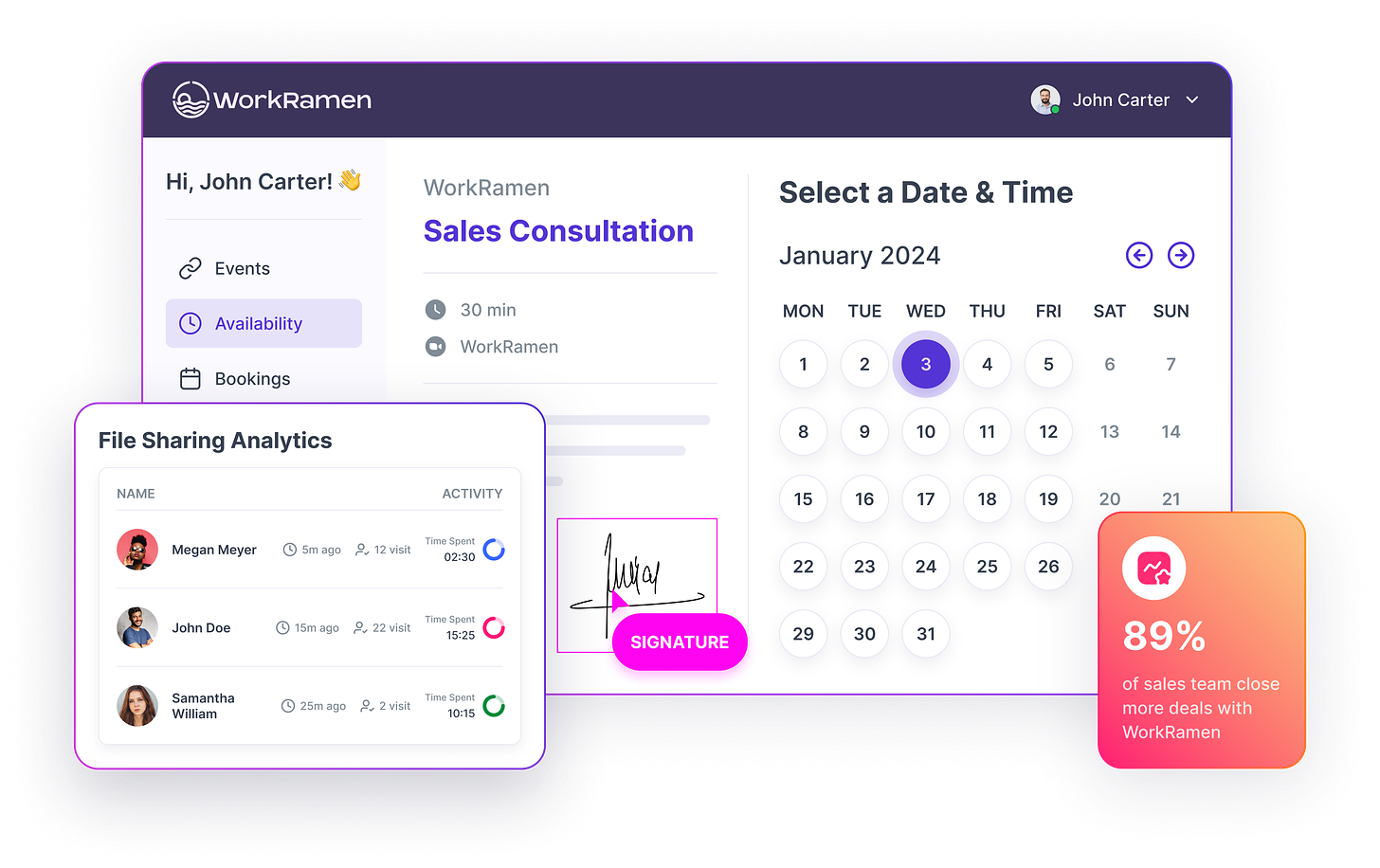

IN PARTNERSHIP WITH WORK-RAMEN

Streamline Your Scheduling, Signing and Sharing Workflow.

Using Calendly, DocuSign, and DocSend? Switch to WorkRamen for just USD 6/mth!

Schedule meetings across multiple event types, sign documents with audit trails and share your PDFs with access control and detailed, page-by-page analytics—all from one platform.

Save time and enhance your workflow.

Join hundreds of founders and business owners. Start your free trial today, no credit card is required.

PARTNERSHIP WITH US

Want to get your brand in front of thousands of founders, investors, executives, and startup operators? For details on our sponsorships, fill up this quick form and we’ll get in touch.

TODAY’S DEEP DIVE

What Do Investors Need From The Problem Slide?

“Every day, we receive tons of pitch decks from founders, but I found that more than 95% of these pitch decks, including the most important slide, i.e., the problem slide, were poorly written,” said Pre-Seed / Seed Stage VC Partner.

He shared -

“Throw half a dozen entrepreneurs in a room together with a whiteboard, and they’ll be able to come up with a thousand business ideas in a couple of hours. It’s the nature of entrepreneurship. Our brains are wired to keep an eye on what could be better and how that gap in the market can be turned into an opportunity. In other words: Ideas are cheap, and nothing is so awesome that it couldn’t possibly be improved.

However, not all problems are worth solving.

There are two common problems with the problem slide. Some founders are tempted to go way into the weeds on this slide, explaining the competitive landscape, market size, customer segments, value propositions and more. I understand the temptation — the problem formulation does touch a large number of aspects of the business — but this is neither the time nor the place.

The other common issue I see in pitch decks is the absence of a problem slide. This happens particularly often with founders who believe that their solution and product slides are so good that the problem itself is obvious and a slide talking about it is redundant. That is a mistake. Even if the problem is universally understood, it’s helpful to see how a founder frames the problem. There are some elegant ways of doing that.

What is the problem?

Being able to clearly outline the problem is a crucial first step toward explaining why people might want a solution. Explaining succinctly and clearly what the problem is can be surprisingly hard for some companies, while others have a much easier path toward a problem statement.

A few examples:

Internet connectivity is poor in many parts of the world. (Solution: Iridium’s satellite hotspot.)

Satellites, once launched into space, are either stuck in their predefined orbits or need to bring complex propulsion systems and fuel with them. (Solution: Atomos space tug boats.)

Training staff is hard and expensive to do consistently. (Solution: Gemba’s VR training platform.)

Limited access to personalized and contextual language learning (Solution: Duolingo - AI-powered language learning app with personalized lessons)

Now, we can argue about what the market size, customer segment and sensibility of each of these problems are, but all of the above are real problems that companies are working to solve.

Who has this problem?

However you choose to frame the problem statement, the issue you are addressing is being experienced by someone, and it helps to explain to your investors how you are thinking about your user base.

Heads up: Don’t go too far into the weeds here; if you need to break down several different customer segments, that might be what a user persona or a customer archetype slide is for. If you feel the desire to hold up the lens of marketing, then your go-to-market slide is the right place for that. In broad strokes, however, you’ll want to give your investors an overview of what you’re doing here.

You can tell this story by using a single example: “Linda often works on the road but can’t always get reliable internet.” Or by hinting at the market size: “20% of all work-from-home workers lose productivity due to unreliable internet.” What direction you choose depends on how you tell your overall story; some narratives work better with a single example that follows the story of the startup you’re raising money for from slide to slide.

How Are They Currently Solving This Problem?

A startup rarely comes across a real problem that people aren’t currently solving in any way. Whenever I’m presented with “people aren’t currently solving this because there is no solution” in a pitch deck, that’s an enormous red flag. If people aren’t experiencing enough pain to solve the problem, why would they start solving it now?

For the smart mug Ember, for example, the problem might be “My coffee goes cold when I’m working.” There’s an existing solution: Make new coffee or put your cup in the microwave for a few minutes. The former takes a few minutes and is wasteful with your coffee. The latter takes a minute but may ruin your flow of work.

Here, we can argue whether anyone truly needs an electric coffee mug (I have one, I use it every day and I love it, but I’m a particularly gear-forward nerdy weirdo), but the point is: Ember can point to a problem that many people are experiencing and have existing solutions for. The question becomes “Is Ember’s solution sufficiently better than the existing solution that people are willing to pay $130 to not have to stumble over to the microwave every couple of hours?” That’s a market sizing and go-to-market question; don’t waste your time with that on this slide — that’s a different part of your narrative.

What are they willing to sacrifice for their current solution?

Assuming you found customers who have a current solution to a problem, you can discover what they are currently willing to sacrifice to “solve” their problem. Some problems are solved with money. Others are solved with time. Others again are solved with inconvenience or suffering the pain without solving the problem.

Imagine having to send a letter. The solution to writing an address on the envelope is simple: You use a pen.

Now imagine having to send 30 letters. You could use a pen, but now you might want to load your envelopes into a printer instead and use a mail merge software package to print each of the envelopes.

Now imagine having to send a hundred letters. Perhaps a label printer starts to make more sense because envelopes jam in home printers frustratingly often.

Ten thousand letters? Forget about it — it’s time to start outsourcing and using a direct mail provider. That is a huge financial outlay, but letting machines take care of the printing and shipping makes more sense than stuffing envelopes by hand.

The opportunity for a startup is solving a problem in a way that is — in one dimension or another — better than the existing solutions. That doesn’t necessarily have to mean that it has to be cheaper or even faster smaller or more convenient than the existing solutions, but it has to be more “right” for the target audience than their current options.

What’s wrong with the way they are currently solving this problem?

User research is an essential part of your customer discovery journey. Talking to a lot of different customers about how they solve particular problems is helpful.

Imagine the “problem” you are solving is that offices look sad and lifeless. The solution you’ve come up with is an elegant way of hydroponically growing plants in a way that looks beautiful and needs very little maintenance. To figure out if that even makes sense, you need to learn a lot about how offices currently deal with plants.

Some offices have an office manager who buys plants and sometimes waters them. That only works if they remember to water the plants and know enough about plants to choose the right ones based on the temperature and lighting in the office building. Some offices are effectively “renting” the plants, and the service contract comes with someone who looks after them. Other offices may have landscapers on staff. Some might decide to order posters with photos of plants or use silk or plastic plants.

All of these solutions have their pros and cons; price, convenience, longevity, sustainability, etc. Be aware of all of them, and perhaps highlight the one that is most relevant to your value proposition. Careful, though, again: Your full competitive breakdown goes on the competition slide. Your full differentiated market segmentation goes on the go-to-market slide. And if you have a distinct value proposition, well, you can break that off onto a separate slide, too.

Think company-sized, not product-sized

In the context of fundraising, remember that a feature is not a product. You may create a tool to help people write canned responses to their emails. “Tom sends 900 emails per day, and he finds that he is often saying the same things again and again. He is copying and pasting snippets of text from a Word document he created, but that’s not efficient.”

On the face of it, that’s a real problem worth solving. But is Tom willing to pay for it? Creating it as a standalone company might make sense. Still, it is hard to imagine it being a billion-dollar company. If you get successful enough, other companies will launch templating systems for an email in their core offering. At that point, your business will become irrelevant overnight. To wit, Gmail has templates built-in, and most customer relationship management (CRM) software has snippets and templates built-in, too.

Use Great Examples!

When telling the story of the problem, it’s helpful to have some examples of how people are currently solving the problem: “Company X had to hire four full-time staff and buy $50,000 of telecoms equipment to set up their SMS infrastructure” is a great way to bring Twilio to life.

“For your web shop, the running of server hardware is painful and unpredictable. If you have a sudden spike in traffic, it can take weeks to get extra capacity, and you might lose millions of dollars as the web pages are unavailable,” is a compelling argument for Amazon Web Services (AWS).

“Linda needs to hire an assistant to deal with her workload” is an excellent argument for automatic account reconciliation and reminder-sending software solutions.

Your job as the founder is to draw a solid, realistic picture of the problem you’re about to solve, explain the pressing need people have for addressing the issue and give an indication of how prevalent the problem is.

Don’t forget to include the risks or costs of what happens if the question remains unsolved. If your “problem slide” ticks all of those boxes, you’re on the right path.”

Using this framework, reply to this email with the problem you are solving. If it’s interesting, will help you to connect with the investors…

✨ Updates: Reg. Premium Venture Curator Newsletter & Community

Recently, we announced a premium venture curator newsletter and community. We received many positive responses and gained a significant number of premium subscriptions from your end.

However, due to technical issues, we have had to temporarily halt this premium content and community. Please rest assured that we are actively working on resolving these issues to provide you with a smoother experience. Once resolved, we will make an announcement. Thank you for your understanding

QUICK DIVES

1. Udemy Founder - “The investors had the right question, but the wrong conclusion.”

Recently Udemy founder Gagan Biyani shared his journey of raising funds for Udemy. He shared -

“When we started Udemy, a common investor challenge was: Why couldn't YouTube do this?

The answer is paradoxical...

YouTube provides more online education than any other platform in the world. But this HELPED Udemy grow instead of hurting Udemy's growth.

Udemy became the place you went when YouTube failed. YouTube created the demand and behaviour of watching educational videos online, but it didn't quite solve the same need as Udemy. They were incentivized to constantly get you to watch other videos and the creators were incentivized to post one-off videos rather than full, in-depth courses.

Users would go to YouTube, watch a 5-minute video on Python, and then realize they needed more. They'd see a $10 Udemy course on Python and receive the exact antidote to the problem created by YouTube.

So, yes, YouTube did become a huge competitor to Udemy. But:

The market for online learning was bigger than anyone expected

Udemy benefited from the competition with YouTube

YouTube never offered our exact product because it was "too small"

Today, Udemy does $300M of sales of courses that are essentially just 50 YouTube-style videos put together into a thoughtful course.

The investors had the right question, but the wrong conclusion!”

As a founder see big competitors as potential helpers, not just threats.

Look for needs the big player doesn't meet well. That's your opportunity. Udemy found YouTube taught people to watch videos to learn but didn't provide full courses. So Udemy gave structured learning that YouTube lacked.

The big player gets people used to your type of product or service. You can then give an improved, specialized version they'll want.

Don't assume the market is too small just because a giant is there. The market is often bigger than it seems.

You can both compete and cooperate with the big players in some ways. Use what helps you; avoid what doesn't.

Most importantly, execute well. Constantly make your offering better than theirs for your targeted needs. Stay nimble as the market changes.

2. How to Sell Your Business Model to VCs?

When it comes to the business model, it’s not enough to simply describe your pricing. To convince investors, your slide must explain the following:

- how you will make money

- why that engine will be efficient

- how it will turn into a competitive advantage in the long run

And that’s where things get tricky. Many believe the best course of action is stripping the business model slide to the bones and avoiding burdening it with unnecessary metrics and information. The problems begin when some of those metrics and information you leave out turn out to be pretty darn necessary for selling your model to investors.

So here are the 4 mistakes that I see founders make, and ways to fix them:

1. Mistake #1: Treating Your Business Model as a Pricing Slide

Instead of just listing pricing tiers, explain the overall mechanics of your business model, including primary revenue streams (subscriptions, transaction fees, etc.), and the logic/key drivers behind them.

2. Mistake #2: Having Too Many Revenue Streams

Early-stage companies should focus on a maximum of 3 core revenue streams, with 1-2 being the primary focus. Differentiate between current and future revenue sources.

3. Mistake #3: Not Showing Your Competitive Advantage

Highlight the unique competitive edge or "moat" that makes your business model sustainable and de-risks it for investors (e.g., low costs, high margins, effective land and expand motion, scalability).

4. Mistake #4: Not Discussing Business Model Economics

Illustrate the attractive aspects of your unit economics to support your claims, such as low Customer Acquisition Cost (CAC), high Customer Lifetime Value (LTV), favourable LTV: CAC ratio, short payback cycles, and high profit margins.

Bonus Tip

The Ultimate Business Model Slide Investors love a slide that concisely presents the key business model drivers, the path to $100M+ revenue, and verification against the overall market size.

So, keep your business model slide clean, focus on the primary model and key revenue streams, and include a few crucial unit economics metrics to justify your strategy.

3. Why Your Startup Idea Isn’t Big Enough for Some VCs? - RTF Analysis.

During the startup pitch, investors focus on one question: "Can this startup become worth a billion dollars?" If they don't see that potential, the startup is often rejected. But how do they calculate this potential?

VC functions with a power law where the majority of a fund’s returns come from a small % of investments. Because of this, VCs need to know if a single investment can return the entire fund.

Remember: Venture capital is not a home-run business, It’s a grand slam business.” This is where the Return The Fund (RTF) analysis comes into play.

For a venture fund, most investments deliver 0–2x returns, with some reaching 2–5x. The real game-changer is a rare "unicorn" outcome of 10x+, essential for the fund to achieve top-tier 3x returns.

Venture success hinges on a few grand slam investments that "return the fund,".

The math for an RTF (Return The Fund) analysis is pretty simple:

Fund Size / % owned at exit = Minimum Viable Exit

Let's understand this with a simple example, Consider startup XY AI is raising a $2M seed round at a $10M post-money valuation (selling 20% of their company).

VC Fund A is a $50M seed fund investing $1M

$1M/$10M valuation = 10% ownership

To return the fund, XY AI must exit for (50/.1) = $500M

A $50M fund, likely unable to maintain pro-rata in all rounds, may face 20% dilution. Assuming this, the actual return to the fund is $625M ($50M/.08). It accounts for the potential dilution impact on returns.

To pass RTF analysis, Fund A must believe XY AI's exit at a minimum of $500M, preferably $625M.

Now let’s look at a larger fund model.

VC Fund B is a $250M seed + series A fund investing $1M in XY AI

$1M/$10M valuation = 10% ownership

To return the fund, XY AI will exit for $2.5B ($250M fund / 10% ownership).

VC Fund B maintains at least 10% ownership in XY AI and anticipates an additional 5% on average. For a favourable exit, they are banking on a $1.66B valuation, representing a 15% stake.

As an investor, the difference between a company exiting for $500M vs. $2.5B is not trivial. The startup number with these exits is always at the lower end.

As a Founder consider investors' philosophies, noting that some startups are suited for exits in the millions, larger funds may push for riskier strategies, aiming for rare grand slam successes that defy natural exit.

RTF analysis is a useful quick check for ownership and investment size, but it's just one part of the larger Due diligence. It helps investors plan their positions, but in the world of startups, there are always outliers.

4. Do Startups Need a Financial Model?

Honestly, financial models are controversial when you’re fundraising. I hope most of you came across this tweet.

Jenny was a Managing Director at Techstars for 7 years and has backed unicorns at the earliest stages. For her and many investors outside Silicon Valley, having a financial model indicates a founder is thinking critically about understanding levers to grow their business. But for others, it's a red flag that the founder prioritizes things that don't matter or doesn't realize everything about their plan will change over the company's life. So let me break down both sides:

Why Would You Not Want a Financial Model?

Any initial plan gets changed quickly and many times before learning how your customer responds.

You could have learned what you now know faster if not spending time on the initial plan.

Your projections will be wildly wrong.

The levers you have may not end up being what you think - the entire business may change.

Signals Investors Look For

Investors look to de-risk by assessing if you "get" what being a founder will be like.

Signals are: how well you know to prioritize time, and whether you realize everything will change from your "plan".

Presenting detailed financial projections at pre-seed fails both those tests.

Why a Financial Model is Useful

Jenny uses it as a proxy for whether a founder can break down incentives and value levers in a problem space.

She wants to trust the founder can quickly evaluate new opportunities if the business needs to change.

It's a way of de-risking and reaching conviction.

Perspectives Outside Silicon Valley

Pre-seed investors often want a multi-year model and data room.

In SF, more focus is on backing the right team/market and assuming the rest figures out.

Factors: startup culture penetration, capital availability, and the density of great builders.

The Truth

Each investor is different in what traits they value and how they reach conviction.

Know your investor - talk to their backed founders, and read their content.

Think about the type of investor you want as a partner based on their evaluation approach.

Join 18000+ Founders, Investors and Startup Enthusiasts Getting Tactics To Build, Learn and Implement About Startups and Venture Capital.

THIS WEEK’S NEWS RECAP

Major News In VC, Startup Funding & Tech

SoftBank Leads $1 Billion Funding For Self-Driving Startup Wayve. Read Here

Apple co-founder Steve Wozniak's space data startup Privateer has raised $56.5 million. Read Here

Microsoft’s consumer AI group has started training a new large language model codenamed MAI-1 to compete with Google, Anthropic & Open AI. Read Here

Pete Sonsini, an early investor in Databricks, is launching a new venture capital firm by collaborating with Databricks co-founder Andy Konwinski. Read Here

KKR is set to acquire Indian Medical Device - Healthium Medtech Ltd. Company at $1 Billion. Read Here

Bluesky's most prominent backer, Jack Dorsey, has left its board without explanation. Read Here

→ Get the most important startup funding, venture capital & tech news. Join 13,000+ early adopters staying ahead of the curve, for free. Subscribed to Venture Daily Digest Newsletter.

TWEET OF THIS WEEK

Best Tweet I Saw This Week

How Can I Help You?

Build Your Pitch Deck: We write, design and model your pitch deck into a storyteller book within 4-5 days.

Get Your MVP In 15 Days: Have an Idea? Turn your idea into Reality. Move fast before your competitors.

TODAY’S JOB OPPORTUNITIES

Venture Capital Jobs & Internships

Social Media Manager - Flight Fund | UK - Apply Here

Analyst - Endiya Partner | India - Apply Here

Principal - Real Tech Holding | Singapore - Apply Here

Finance Intern - Nama Venture | Phillippines - Apply Here

Sustainability Senior Associate - Yamaha Motor Venture | USA - Apply Here

Senior Analyst - Chan Zuckerberg Initiative | USA - Apply Here

Investment Analyst - Volta Circle | UK - Apply Here

Director, Strategic Investments - FIS Venture | USA - Apply Here

Community Analyst - Fin Capital | USA - Apply Here

Investment Analyst /Associate/partner/director / Investor relation - Fin Capital | USA - Apply Here

Operations Specialist - BHP Ventue | USA - Apply Here

Investment Analyst - Primo Venture | Italy - Apply Here

Launchpad Associate - M13 | USA - Apply Here

MBA Intern - XRV Venture | USA - Apply Here

🧐 Some Tips To Break Into VC:

A guaranteed question you’ll be asked in a VC interview is ‘Why venture capital?’. Having a thoughtful response to this is crucial. Here are 3 key questions to ask yourself when prepping your answer👇🏼

What does the day-to-day role look like in this position and what do I like about it?

What excites me about working with startups?

How does this fit within my experience and future career goals?

VCs want to know that you’re aware of what you’re getting yourself into & that you’ve intentionally chosen this as your next career move.

(Shared By Nicole DeTommaso.)

→ Looking To Break Into Venture Capital?: Join our VC Crafter community and get access to VC learning resources, daily VC job updates, daily discussion sessions, 1:1 call access, worked as a scout for various VC firms, a CV/Interview preparation guide and more. Don’t miss this opportunity….

→ Looking to hire for your VC Firm?: We have a curated list of VC enthusiasts - from leading universities, ex-founders, and operators. Get free access here.