Negotiating a VC Funding Round - What to Expect and How to Reply? | VC Jobs

Easly Stage Startup Financial Modelling Template & The 4 P's of AI

👋Hey Sahil here! Welcome to this bi-weekly venture curator newsletter. Each week, I tackle questions about building products, startups, growth, and venture capital! In today’s newsletter, we dive into -

Deep Dive: Negotiate VC Funding Round? What to Expect and How to Reply?

Quick Dive:

Do Early-Stage Startups Need a Financial Model For Fundraising?

Steve Jobs on Ideas and Products

Adobe’s Scott Belsky's The 4 P’s of AI

Venture Curator Hub: Get Access To Early-stage startup financial modelling Excel sheet, 10000+ verified investors' email contact database & more.

Major News: Amazon's 'safer' AI chatbot, xAI moves to OpenAI's old HQ, Google's new AI model, Telegram CEO on privacy post-arrest & More

Best Tweet Of This Week On Startups, VC & AI.

20+ VC Jobs & Internships: From Scout to Partner.

A MESSAGE FROM OUR PARTNER MYMIND

Remember everything. Organize nothing.

mymind is like a search engine for your own brain.

Save bookmarks, inspiration, articles, notes, videos & images with one click.

mymind organizes and tags everything for you with the help of AI. To find something later, just search for it.

The best part is that it’s 100% private. No ads, no tracking, no social pressure.

PARTNERSHIP WITH US

Reach 62,000+ Founders & Investors: Partner with our venture curator newsletter to reach a highly engaged audience.

Build Your Pitch Deck: We write, design and model your pitch deck into a storyteller book within 4-5 days.

Get Your MVP In 15 Days: Have an Idea? Turn your idea into Reality. Move fast before your competitors.

TODAY’S DEEP DIVE

Negotiate VC Funding Round - What to Expect and How to Reply?

Top Founders know that fundraising is a critical skill that’s much harder than meets the eye. But what’s rarely discussed is “Fundraising is a learned skill.” And VCs almost always have the upper hand because they deal with it all day, every day.

In reality, knowing what to expect from VCs – the negotiation dynamics Founders are likely to encounter – is half the battle.

Before you start talking with VCs, take the time to learn how to detect and manage these little-known fundraising dynamics. Let’s dig in. ( We are sharing this in a more conversational format….)

The Portfolio Trap

VC: "I'd like you to meet with one of our portfolio companies in your space. They can provide valuable insights, and we'd appreciate their perspective on your venture."

This request often puts founders in a tricky position. Sharing your plans with a potential competitor can be risky, and the existing portfolio company has little incentive to endorse your startup. They may tell the VC they're planning to expand into your area, making it challenging for the investor to back you. While VCs might have good intentions, this practice can sometimes backfire or be used to gather intelligence for their existing investments.

Founder’s Reply: If the suggested company is too close to your business, politely decline:

"I appreciate the offer and value your network. However, given the significant overlap between our business and this portfolio company, I'm not comfortable sharing our strategic plans. Perhaps we could meet with other industry experts who aren't directly in our space?"

If the portfolio company isn't a direct competitor, consider accepting:

"Thank you for the introduction. I'd be happy to meet with them. It would be valuable to hear about their experience working with your firm and get their industry insights."

Remember, your goal is to protect your business interests while maintaining a positive relationship with the potential investor. If you do meet, use it as an opportunity to learn about the VC's support and working style from an existing portfolio founder's perspective.

The Valuation Conversation

VC: "What valuation are you looking for in this round?" or "What's your target price for the company?"

This question is a common tactic used by VCs to gauge your expectations and potentially anchor negotiations at a lower point. While it's a legitimate inquiry, it can be a pitfall for founders who, in an attempt to appear reasonable, might suggest a valuation below their company's true worth. Remember, any figure you mention could become the ceiling, not the floor, for further discussion.

Founder’s Reply: Unless you're dealing with a priced extension round or a convertible note with predetermined terms, it's wise to defer to market dynamics. A tactful response might be:

"We're open to letting the market determine our valuation. We're more focused on finding the right partners who can add value beyond just capital."

If you've had a previous funding round, you can provide context without committing to a specific number:

"Our last round valued the company at $X million post-money. Since then, we've achieved significant milestones, including [brief mention of key metrics or achievements]. We believe these developments have substantially increased our value, but we're eager to hear the market's perspective."

This approach demonstrates confidence in your company's progress while leaving room for negotiation and avoiding the trap of undervaluing your startup prematurely.

Turn Into Home Run

VC: "Based on our analysis, we'd like to offer you $X million at a valuation of $Y million."

This initial offer might seem disappointingly low. It's a common strategy in VC negotiations, often serving as a starting point rather than a final stance. Inexperienced founders sometimes react emotionally, potentially derailing a deal that could have been salvaged with the right approach.

Founder’s Reply: The key is to remain composed and professional. A strategic response might look like this:

"Thank you for your offer. We appreciate your interest in our company. While this valuation is considerably below our expectations, we'd like to take some time to review it in detail. We'll get back to you soon with our thoughts."

This response acknowledges the offer without accepting or rejecting it outright. It buys you time to explore other options and potentially leverage them.

If you receive more attractive offers later, you can circle back:

"We've had some time to consider your offer and explore the market. We've received interest at significantly higher valuations that better align with our growth trajectory and potential. We value our relationship and wanted to allow you to revisit your offer if you're interested. If not, we completely understand and hope to stay in touch for future opportunities."

This approach keeps the door open while signalling that you have other options. It gives the VC a chance to improve its offer without burning bridges. Remember, maintaining positive relationships in the VC world can be beneficial for future funding rounds or networking opportunities.

Deflect the Friendly Lowball

VC: After a warm, engaging meeting filled with enthusiasm and positive feedback, the VC follows up with a surprisingly low offer. This unexpected contrast between their friendly demeanour and the underwhelming valuation can catch founders off guard.

This scenario often leads founders to doubt their judgment or feel pressured to accept a subpar offer due to the perceived rapport. It's a subtle tactic that leverages the positive connection established during the meeting.

Founder’s Reply: The key is to maintain your composure and separate your emotions from the business decision at hand. A balanced response might look like this:

"Thank you for the offer. We truly enjoyed our meeting and appreciate your enthusiasm for our vision. However, the proposed valuation is significantly lower than what we believe reflects our company's current value and potential. We'd like to take some time to carefully consider this offer in the context of our market research and growth projections. We'll get back to you soon with our thoughts on how we might bridge this gap."

If the VC doesn't adjust their offer, you can follow up with:

"We've given your offer careful consideration. While we greatly value the potential of working together, we feel that this valuation doesn't align with our company's trajectory and the current market. We're open to further discussion if there's room for adjustment. If not, we hope to keep the door open for future opportunities as our company grows."

This approach maintains a positive relationship while firmly asserting your company's value. It leaves room for negotiation without committing to an undervalued deal. Remember, a good partnership should be mutually beneficial, balancing enthusiasm with fair terms.

Focus on Pre-Money Valuation

VC: "We're looking at investing $2M at an $8M post-money valuation."

VCs often frame discussions in post-money terms, which can lead to confusion and potentially reduced founder ownership if the round size changes.

Founder’s Reply: "Thank you for the offer. To ensure we're on the same page, let's discuss this in terms of pre-money valuation. Based on your proposal, we're looking at a $6M pre-money valuation. Is that correct? We prefer to focus on pre-money valuation as our fundraising target may adjust."

ESOP Negotiations

VC: "We'd like to see a 20% ESOP allocation before the round."

VCs often push for large ESOP pools to reduce their future dilution. They may request excessive allocations, sometimes up to 20% or more, which can significantly impact founder ownership.

Founder’s Reply: "We've analyzed our hiring needs until the next funding round. Based on our projections, a 10% post-round ESOP pool should suffice. This includes 2% for a key hire we've identified and 5% for additional team members over the next 18 months. This aligns with market standards for seed rounds and ensures we have enough to attract top talent without over-diluting existing shareholders. We're open to discussing specific concerns you may have about our hiring plan."

Distinguish Genuine Interest

VC: "We're interested in investing, but we'd need you to find a lead investor first," or "We'd like to commit, contingent on you raising the rest of the round."

VCs often use these tactics to keep their options open without fully committing. They're expressing interest but aren't ready to take the lead or make a firm commitment.

Founder’s Reply: "We appreciate your interest in our company. We're currently focusing on investors who are ready to commit without contingencies. Once we secure our lead investor, we'll reach out if there's still room in the round. In the meantime, would you be open to introducing us to any potential lead investors in your network?"

This response politely acknowledges their interest while prioritizing more committed investors. It also leaves the door open for future participation and potentially leverages their network.

That’s it.

VENTURE CURATOR HUB

Access Curated Resources, Support Our Newsletter

Early Stage Startup Financial Model Template For Fundraising (Access Here)

2700+ US Angel Investors & VC Firms Contact Database (Email + LinkedIn Link) (Access Here)

400+ French Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link) (Access Here)

1000+ Euro Tech Angel Investors & VC Firms Database (Access Here)

350+ Indian Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link) (Access Here)

Building Cap Table As A Founder: Template to Download (Access Here)

QUICK DIVES

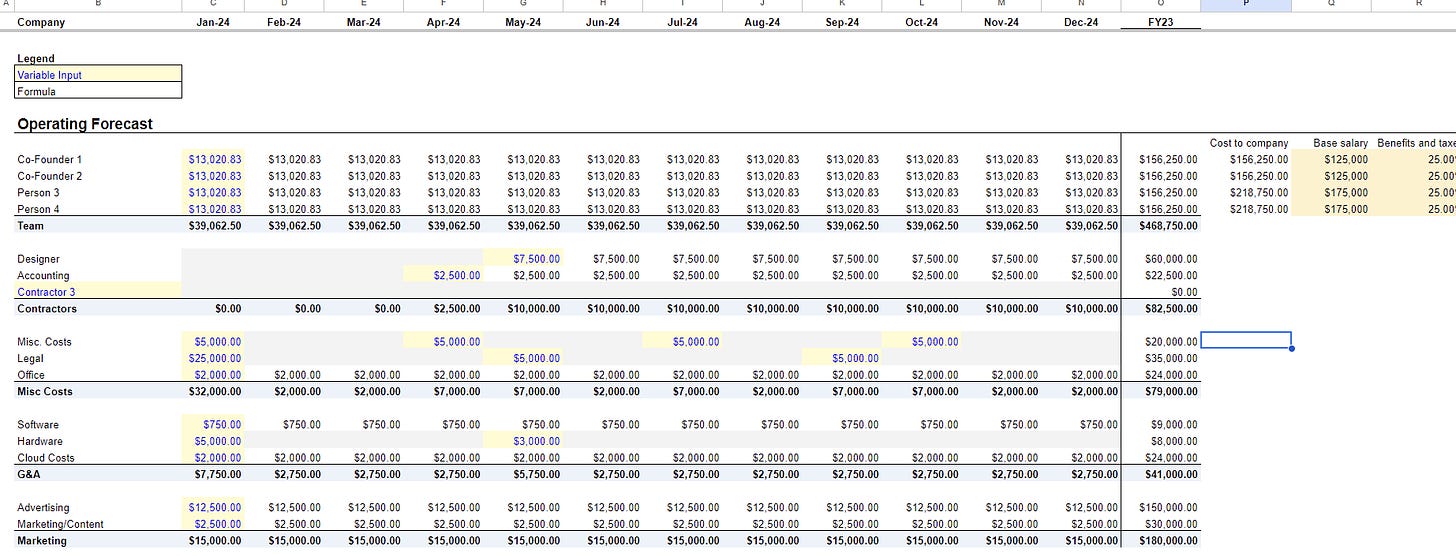

1. Do Early-Stage Startups Need a Financial Model For Fundraising?

When you learn about entrepreneurship in school you’re taught to have a clear, strong business plan and financial model when you start out, and to use that as a way to communicate the path your business will take.

You can access the fincnial modelling template here.

The real world is much messier. Any plan you had when you started gets changed quickly. Every day or even hour of your time that you devote to your startup needs to be spent getting it off the ground. The same is true for a financial model. Your projections will be wildly wrong.

Not only that, but the levers you have at your disposal in the model may not end up being what you think they’ll be — the entire business may change, and you likely don’t know enough yet at the pre-seed stage to be sure.

Investors all know this. They see tons of startups and have many first-hand data points showing that everything can change and often does.

What they don’t know is if YOU know that.

Investors are looking to de-risk the idea of investing in you. Startups are inherently so risky that they look for ways to think of your startup as less risky than others. One of those ways is to assess your founder mindset — how much do you “get” what being a founder will really be like?

The thinking there is that the more you “get” it the more you’ll be able to anticipate challenges and be emotionally steady when things get rocky.

This is a very common place where first-time founders and founders who don’t have a strong network fail to build trust with an investor. That might not be fair, but it’s true. Two of those signals for how well someone is ready to be a venture-backed founder are:

How well do they know how to prioritize their time? - Whether they realize everything will change from their “plan” or not. Presenting investors with detailed financial projections at the pre-seed stage fails both of those tests.

Get free access to the financial model template.

Ok… So Why is a Financial Model Useful?

VCs who want to see a model use it as a proxy for understanding whether a founder can correctly break down the incentives and value levers in a problem space.

VCs want to trust that if the business needs to change, the founder will be able to quickly figure out how to evaluate new opportunities and position their product for success in a new market. It's just a different way of de-risking an investment opportunity.

The simple takeaway is that each investor is different in what traits they value and how they reach conviction. So Know your investor - talk to their backed founders, and read their content. Think about the type of investor you want as a partner based on their evaluation approach.

2. Steve Jobs on Ideas and Products

The hardest part about being a founder isn’t finding a good opportunity, it’s everything that comes after.

You learn little things every day that you need to remember and piece together into a product. It’s impossible to get it exactly right ahead of time — you need to listen and learn.

This is why being a founder is such an intense “job.”

You need to constantly make the tradeoff between moving as fast as possible and implementing true craftsmanship into your product. You can’t assume either will happen — you need to be in the details with your team and your users on every bit of it.

Steve Jobs talked about the importance of craftsmanship, which clearly came through in Apple’s products during his lifetime:

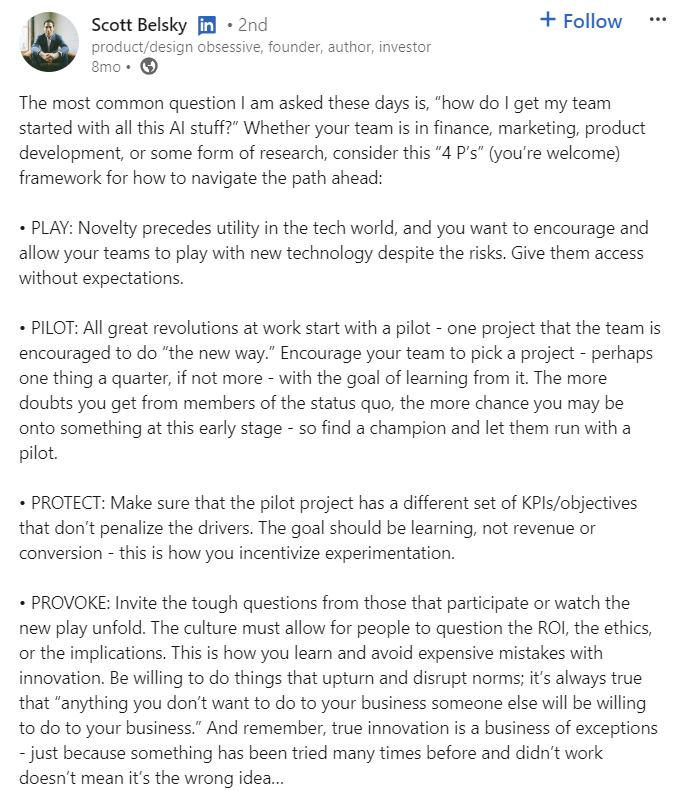

3. The 4 P’s of AI

If you ever took a marketing class in college you’re probably groaning right now because you’ve heard of the “4 P’s of marketing. - Product, Price, Place, Promotion.”

Unfortunately, this framework is named the 4 P’s as well, but it is more practical for startups. Adobe’s Scott Belsky broke down the lifecycle of going from discovering a new AI tool up to when it becomes part of your normal workflow.

It’s relevant regardless of whether your team is just yourself and your cofounders, or if you’ve built a much bigger org:

Join 35000+ Founders, Investors and Startup Enthusiasts Getting Tactics To Build, Learn and Implement About Startups and Venture Capital.

THIS WEEK’S NEWS RECAP

Major News In VC, Startup Funding & Tech

In early October 2024, Nvidia surprised the AI community by unveiling NVLM 1.0, a series of advanced multimodal language models with capabilities matching those of the GPT-4o model from ChatGPT. (More Here)

Australian court upholds order for Musk's X to pay $418,000 fine over anti-child abuse probe. (More Here)

Tim Brooks, a co-lead on OpenAI's Sora video generator, has left to join Google DeepMind. (More Here)

Amazon recently rolled out a new AI chatbot that is 'safer than ChatGPT' for employees to use.(More Here)

Telegram CEO Pavel Durov insists ‘little has changed’ in the app’s privacy policies since his arrest. (More Here)

→ Get the most important startup funding, venture capital & tech news. Join 25,000+ early adopters staying ahead of the curve, for free. Subscribed to Venture Daily Digest Newsletter.

TWEET OF THIS WEEK

Best Tweet I Saw This Week

Entrepreneurship is a spiritual battleground…

How Can I Help You?

Build Your Pitch Deck: We write, design and model your pitch deck into a storyteller book within 4-5 days.

Get Your MVP In 15 Days: Have an Idea? Turn your idea into Reality. Move fast before your competitors.

Reach 62,000+ Founders & Investors: Partner with our venture curator newsletter to reach a highly engaged audience.

TODAY’S JOB OPPORTUNITIES

Venture Capital Jobs & Internships

Get access to our all-in-one VC interview preparation guide - check out here, we are giving a 30% discount for a limited time. Don’t miss this.

Associate, Investment - Singtel | Singapore - Apply Here

Partner 18, Deal Operations - a16z | USA - Apply Here

Venture Capital Chief of Staff - Sidekick Partner | USA - Apply Here

Portfolio Success Manager - Climate Pledge Fund | USA - Apply Here

Investment Associate - Triatomic Capital | USA - Apply Here

Investment Principal - Triatomic Capital | USA - Apply Here

2025 Venture Capital – Growth Strategy Summer Analyst - Stepstone | USA - Apply Here

Ecosystem Engagement Intern - Iveycap venture | India - Apply Here

Head of Investor Relations - CarbonN venture partner | USA - Apply Here

Vice President of Investment - K3 Venture | Singapore - Apply Here

Digital Marketing and Social Media Marketing Intern - QI Venture | India - Apply Here

Looking To Break Into Venture Capital?- Join our VC Crafter community and get access to VC learning resources, daily VC job updates, daily discussion sessions, 1:1 call access, worked as a scout for various VC firms, a CV/Interview preparation guide and more. Don’t miss this opportunity….

That’s It For Today! Happy Tuesday. Will meet You on Friday!

✍️Written By Sahil R | Venture Crew Team