How To Raise Money? Advice From a Founder Who Raised $1 Billion For Startups. | VC Jobs

a16z report: New data on swing states, stablecoins, AI & Higher valuations Forcing VC For Opportunity Funds...

👋Hey Sahil here! Welcome to this bi-weekly venture curator newsletter. Each week, I tackle questions about building products, startups, growth, and venture capital! In today’s newsletter, we dive into -

Quick Dive: How To Raise Money? Advice From Figure AI Founder.

Quick Dive:

Don’t Say These Things During a VC Pitch.

a16z’ 2024 Crypto Report: New data on swing states, stablecoins, AI.

Higher valuations and fewer IPOs are forcing VCs For Opportunity Fund.

Major News: SpaceX's plan to make Starlink 1 Gbps, Nvidia's New AI Model Outperform OpenAI’s GPT, Harry Stebbings' $400 Million 20VC Fund & Chinese Researchers Crack Military-Grade Encryption With Quantum Computer.

Best Tweet Of This Week On Startups, VC & AI.

20+ VC Jobs & Internships: From Scout to Partner.

A MESSAGE FROM OUR PARTNER CONTRAST STUDIO

UI & Brand Design as a Subscription

Move fast without breaking things. Go from idea to polished design faster and safer.

Get our continuous design support for only $5,999/month.

Premium quality

Tasks delivered every 2 days

Daily support in Slack

90 min. per week for calls

Access to our exclusive software discount collection totalling over $1mil.

PARTNERSHIP WITH US

Want to get your brand in front of 62,000+ founders, investors, executives, and startup operators? For details on our sponsorships, fill up this quick form or email us and we’ll get in touch.

VENTURE CURATORS’ FINDING

My favourite finds of the week.

The Rules of a Good Startup Pitch - A Must Follow Framework For Founders. (Read)

The Product-Market Fit Scale - How close are you to product-market fit? (Read)

20 Minutes: From AI-Prompted Tool to Live Landing Page (Read)

The best way to get hired for a VC associate role. (Read)

How much should I budget for ads & marketing to seed my app with its initial users? (Read)

Don’t give away startup equity to advisors. (Read)

Can the subscription model kill your startup? (Read)

How to find customers on Reddit - All-in-one strategy? (Read)

The Truth of Modern Y-Combinator Startups. (Read)

Startup Playbook for Ideation, Execution & Growth. (Read)

TODAY’S DEEP DIVE

How To Raise Money? Advice From a Founder Who Raised $1 Billion For Startups.

The probability of success for a high-growth company is predicated on your ability to raise capital. As a leader, you will never achieve your maximum entrepreneurial potential without being able to raise capital quickly and successfully.

Capital is the lifeblood of any high-growth company. It has to be treated as a key priority. It can never be outsourced or downgraded to a second priority.

Brett Adcock, the founder and CEO of Figure AI, secured $70 million in its Series A funding round in 2023. Also his previous ventures, Adcock has successfully raised significant capital: Vettery was acquired for $110 million, Archer Aviation went public with a valuation of $2.7 billion and raised over $1 billion. He shared the framework for founders to raise capital. So read along -

“Remember - Investors are looking for certain traits. Without these, you have little chance of raising a single dollar. Let's talk about how you can use the formula to build a repeatable process for raising capital.

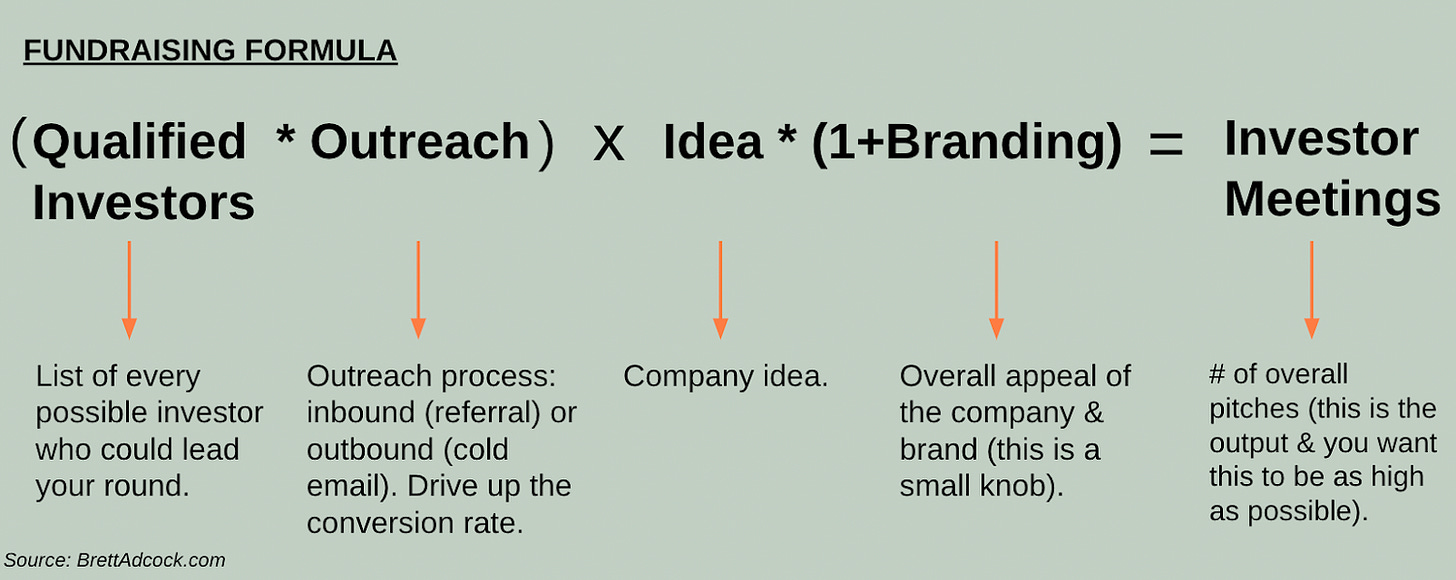

Fundraising Formula:

You need to maximize the amount of shots on goal in fundraising. Aim to get as many meeting attempts with investors as possible. The above formula for capital raising is a combination of -

the number of qualified investors you are targeting combined with

the company idea & overall branding.

The first step in the fundraising process is defining success. The ultimate goal is to raise capital successfully. If you work backwards from there, getting to a lead investor "term sheet" is the next clear milestone. And if you work backwards once more, the goal is to maximize the number of unique investor meetings.

The Fundraising Formula is a way to compute how to maximize the number of qualified investor meetings. Fundraising is about talking to 200 investors and finding the 1 person who will take a bet on you. I've always experienced really low conversion rates in these efforts - it's never been easy for me to raise capital. And that's quite normal.

Here is the sensitivity to each part of the formula:

Qualified investors: You want to drive this number as high as possible. I speak to so many founders who are "waiting for referrals". This inevitably means this number is too low. You want to identify every possible investor on the planet or else your equation will point to low odds of success.

Outreach: This is your reach-out process to investors. I gauge this as a percentage conversion rate. This will be really sensitive to the way you are reaching out (referral vs. cold email) and the messaging associated with the reach-out process (e.g. subject and body of a cold email). There is an art to this. The per cent conversion rate can greatly increase if you treat it as a recursive project to get better.

Idea: This is the company idea ⸺ and it's fixed. There is very little you can do besides pivot your company to a new idea. The idea will instantly either A) resonate or B) turn off investors based on their industry focus or their internal thesis of the market/industry.

Branding: This is how well-branded or attractive your company is at first glance. You have limited time to impress an investor enough for them to commit to a meeting. There are many ways to drive this up, including a nice investor deck. But ultimately that's a small lever so don't stress too much over this.

Investor Meetings: This is the output of all your hard work. The goal is to drive up the number of qualified investor meetings as high as possible. You want to do 50-200 of these meetings. The more qualified investor meetings, the higher your odds of raising capital.

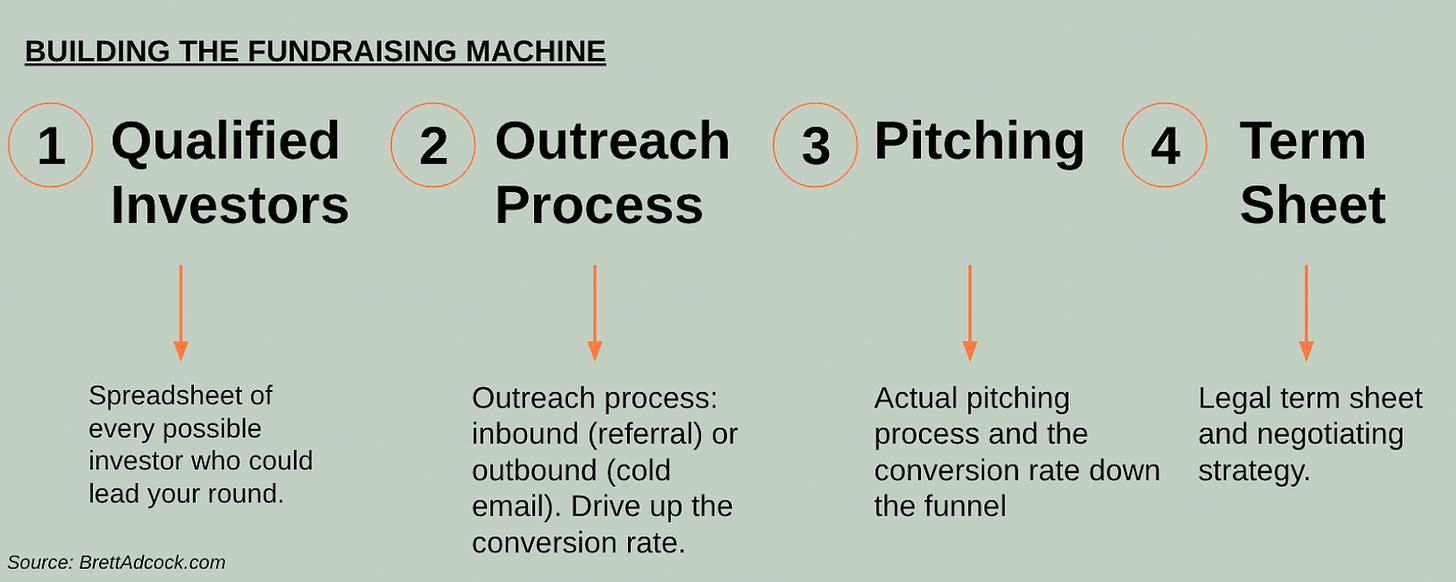

Building the Fundraising Machine:

I believe in building and executing on a highly structured "machine" for fundraising processes. This machine is something you can wash, rinse, and repeat. This should be similar to how you would run a sales or marketing team.

I track this process in a Google sheet, similar to how you track items in a CRM. Let's break down the key elements of the formula so you can go out and execute it yourself.

Key Elements of a Fundraising Machine:

Qualified List of Investors: This is a list of investors who are tailored specifically to your company. Start with investment groups that match well with your company sector. Research to find an investment partner who covers your specific industry and maturity. Ideally, you have found 100% of every investor on the planet that you think could give you a term sheet.

Outreach Process: Reach out to investors with the goal of setting up a meeting. Try to get as many referrals as possible, then move to outbound for the rest.

Pitching: Your first interaction with the investor that includes them previewing the deck. Optimize the conversion rate from the first meeting to the term sheet.

Term Sheet: Receiving a term sheet is the ultimate goal for the first leg of capital raising. Negotiate quickly and fairly to get the lead investor signed up.

The entire process from start to finish will take at least 3 months. Spend 30 days preparing the investor deck, and data room, mapping out investors, and your cold email template. The next 30-60 days are for investor outreach and meetings. Once you have a term sheet, it generally takes <10 days to negotiate and sign, and you usually close in 30 days.

Additional Capital Raising Insights:

Show metrics and customers that can potentially correlate to long-term success for early investors to understand your product's potential.

Understand VC mandates and match them to your industry to avoid spinning your wheels.

Showcase your "Championship Team" - there's no way you're building a great product without a #1 team.

Aim for 80% of investor pitches to come from outbound processes (cold calls or emails) and 20% from inbound processes (referrals).

Build a well-branded investor deck as it's often the first impression investors have.

Recognize that interested investors move quickly. If they're not hurrying, it's likely a sign you don't have a deal.

Focus on finding a "lead" investor who can give you a term sheet and lead your round.

Balance fundraising time with product development, as fundraising can be distracting for founders.

Remember, fundraising is a competitive process. Once the round is complete, put your attention back to the product and get building. I suggest setting up a quarterly "nurture" sequence to keep investors updated.”

QUICK DIVES

1. Don’t Say These Things During a VC Pitch.

There's this classic line I keep hearing in pitch meetings: “We're aiming for a $20M-$100M exit to BigCo in a few years.”

Look, it might be your genuine game plan, and there's nothing wrong with that. But here's the thing – most VCs will mentally check out the moment you say this. Why? Because those numbers just don't move the needle for their fund returns. Plus, you're telling them you're building to sell, not to become massive. Even if that's your real plan, it comes across as thinking too small.

“We’re a bit burnt out after doing this for years.” I feel you. But say this to a VC, and that’s not a sign of founders they want to invest in for the next 5–10 years.

“We need the money to get sales and marketing going.” While logical, again, this isn’t what VCs want to hear. They want to hear you already have at least a tiny core revenue engine going, and the capital is going to feed it. Don't start it.

“Our CTO is leaving.” Important to know. Disclose it. But have a plan in place to address it before you pitch VCs.

“We need a lot of money because our burn rate is pretty high.” It’s not the VCs’ problem if your burn rate is too high. You need to make sure your startup is at least structurally attractive to the VC fund you talk to. Bigger funds can fund bigger burn rates. But you still need to be structurally attractive.

“I don’t know all that much about that key competitor.” The best founders always know the competition is cold. And respect it.

“Our sales are flat but we’ll make it up later in the year.” Prove it. This isn’t the risk VCs want to take.

“Our market is pretty small.” That’s OK if you have some proof you are going to expand it. E-signatures were a $1m a year market when we started Adobe Sign / EchoSign. Today, they are a $3B+ market. But you need to show a clear path for your small market to become a very large one.

“Our product wins because it costs less than the competition.” This rarely wins in SaaS, at least not big. It’s not an enduring competitive advantage.

“Oh those aren’t customers, they’re trials.” Be very careful exaggerating metrics. Don’t count trials as customers. Don’t count deals that haven’t quite closed yet … as closed. Don’t blend 3 months of revenue into “Quarterly MRR” to make your revenue look bigger. You’ll likely get caught. And worse, maybe it wouldn’t have mattered at all to the VC if you’d been honest and clear up-front.

2. a16z’ 2024 Crypto Report: New data on swing states, stablecoins, AI.

a16z just released their 2024 State of the Crypto report with tons of bullish and tech news!

here's everything you need to know:

TLDR:

usage is up and Solana is leading it

developer interest is shifting, the base is up 10.7%

stablecoins booming: $8.5T in q2 2024 transactions

blockchain scaling: capacity up 50x

crypto + AI: 33% of projects using AI

Crypto usage is up in September, 220 million active crypto addresses interacted with blockchains - a new all-time high!

Solana with 100m active addresses

near with 31m active addresses

base with 22m active addresses

tron with 14m active addresses

bitcoin with 11m active addresses

Ethereum had 6m active addresses.

Builder's interests are changing: Solana saw the biggest jump in developer interest, doubling from 5.1% to 11.2%. base also grew, increasing from 7.8% to 10.7%. Ethereum still holds the top spot with 20.8% of builders showing interest

Stablecoins are crushing it: they've found their PMF with $8.5 trillion in transaction volume in q2 2024 - that's more than double Visa's $3.9 trillion! over 99% of stablecoins are pegged to the USD.

Blockchain tech is levelling up: infra improvements have massively increased capacity and slashed transaction costs. blockchains are processing over 50 times more transactions per second than they were four years ago

Defi usage is high: defi remains super popular, attracting tons of builders and users. defi accounts for 34% of daily active addresses. dex now make up 10% of spot crypto trading activity - up from 0% just four years ago. the total value locked in defi protocols is over $169 billion

Crypto and AI will be huge: about a third of crypto projects are using AI, up from 27% last year. there's a significant overlap between crypto and AI users. crypto could help solve some of AI's biggest challenges, like decentralization and democratizing access to compute resources.

crypto is making serious attraction across the board - from tech upgrades to political influence. exciting times ahead!

You can read the detailed report here.

3. Higher valuations and fewer IPOs are forcing VCs For Opportunity Fund.

Let's talk about a fascinating shift happening in VC land, especially with opportunity funds. Here are the key numbers that tell the story:

2021: Peak of the market

120+ opportunity funds launched

A massive $12.1B total raised

VCs were basically printing money

2024 Reality Check:

Only $3.4Braised (though 2x more than 2023)

CRV returning $250M+ of their $500M opportunity fund

Lightspeed trying to raise $7B, with ~40% for opportunity-style investments

Why this massive shift? Let's break it down:

The Classic Pitch Problem "We'll double down on our winners right before IPO!" Yeah... except:

IPO market is basically frozen

Best startups are already overcapitalized

Valuations are through the roof for any promising company

The LP-VC Power Dynamic Remember how it used to work?

Top VCs: "Want in on our early-stage fund? Better invest in our opportunity fund too!"

LPs: "Fine, take our money!"

Now: LPs are the ones pulling back

The Valuation Trap Take CRV's portfolio for example:

Cribl: Just raised $319M at a $3.5B valuation

Airtable: Sitting at an $11.7B valuation from 2021

Both companies = Already flush with cash

The Only Hot Exception: AI

Kleiner Perkins: Just raised $1.2B for their opportunity fund

Focus: AI transformation in:

Healthcare

Legal

Finance

Infrastructure

What's really interesting is how firms are adapting. Instead of the old playbook of "throw more money at winning companies," we're seeing:

Secondary stake purchases

Fund position acquisitions

Turnaround plays for struggling companies

More selective follow-on investments

Here's the bottom line: The opportunity fund isn't dead - it's just getting a major rewrite. The smartest VCs are adapting to a market where having too much money chasing the same deals is actually part of the problem.

As Paul Hsu from Decasonic puts it: The winners in this new world aren't the ones trying to milk fees or chase greed - they're the ones staying focused on what their LPs actually want and need.

Join 35000+ Founders, Investors and Startup Enthusiasts Getting Tactics To Build, Learn and Implement About Startups and Venture Capital.

THIS WEEK’S NEWS RECAP

Major News In VC, Startup Funding & Tech

Y Combinator, Khosla Ventures-Backed CapWay Shuts Down After Raising $800k. (More Here)

After Google, Amazon Invested $500 Million In building nuclear reactors. (More Here)

Nvidia just dropped a new AI model that scratches OpenAI’s GPT. (More Here)

Sam Altman's $15 Million New Investment In Aviation Intelligence Startup. (More Here)

Harry Stebbings & Josh Buckley, former CEO of Product Hunt Launches $400 M & $250 M Fund. (More Here)

Chinese researchers reportedly crack military-grade encryption with quantum computers. (More Here)

US weighs capping exports of AI chips from Nvidia and AMD to some countries. (More Here)

→ Get the most important startup funding, venture capital & tech news. Join 26,000+ early adopters staying ahead of the curve, for free. Subscribed to Venture Daily Digest Newsletter.

TWEET OF THIS WEEK

Best Tweet I Saw This Week

TODAY’S JOB OPPORTUNITIES

Venture Capital Jobs & Internships

Get access to our all-in-one VC interview preparation guide - check out here, we are giving a 30% discount for a limited time. Don’t miss this.

Platform Associate Volta Circle - Apply Here

Associate, Investments - Diagram | Canada - Apply Here

UK Executive Director - Pillar VC | UK - Apply Here

Investment Analyst - Five Capital | USA - Apply Here

Associate, Impact and ESG - Energize Capital | USA - Apply Here

Fund Operations Analyst - Capital Factor | USA - Apply Here

Ventures Associate, AI Investing - Point 72 venture | USA - Apply Here

Student Support – Private Equity Venture Capital team - LGT Capital Partner | Swiss - Apply Here

Senior Associate - Acquity Knowledge Partner | India - Apply Here

Investment Manager CFH Management | Germany - Apply Here

Investment Associate - Virescent Venture | Australia - Apply Here

Analyst Intern - Bregga | UK - Apply Here

Access Curated Resources, Support Our Newsletter

Early Stage Startup Financial Model Template For Fundraising (Access Here)

Building Cap Table As A Founder: Template to Download (Access Here)

2700+ US Angel Investors & VC Firms Contact Database (Email + LinkedIn Link) (Access Here)

400+ French Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link) (Access Here)

1000+ Euro Tech Angel Investors & VC Firms Database (Access Here)

350+ Indian Angel Investors & Venture Capital Firms Contact Database (Email + LinkedIn Link) (Access Here)

That’s It For Today! Happy Friday. Will meet You on Tuesday!

✍️Written By Sahil R | Venture Crew Team

Very insightful! What’s the usual response rate of cold outreach for fundraising?